An equipment lease is a lease agreement for equipment like plant and machinery, vehicles, and other accessories like computers, furniture, etc., used in business or production to avoid the heavy investment in the machinery and effectively utilize the money to earn the maximum returns on investment.

For running the business organization and producing goods, lots of investment in plant, machinery, and other assets are required, which blocks the money for a long time. Hence, some organizations take the machinery and other equipment on a lease basis to avoid heavy investments and prevent the organization from taking debt for investing in machinery. For equipment leasing, only lease rent is to be paid, which saves the organization from heavy investment and blockage of money; the money can be invested in some other way to earn the maximum returns. The ownership in case of equipment leasing will remain with the leasing company. Maintenance charges are borne per the leasing company’s and the lessee’s agreement, i.e., business organization.

ADVERTISEMENT Popular Course in this category FINANCIAL MODELING & VALUATION - Specialization | 51 Course Series | 30 Mock TestsDownload Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Let’s take an example to understand the equipment lease calculation better.

You can download this Equipment Lease Excel Template here – Equipment Lease Excel TemplateAn Ltd needed machinery for one year to complete the export order at the earliest. The machine cost was $ 50,000, and the monthly lease rent was $ 3,500. The rate of loans prevailing in the market was 7%. Suggest the company purchase the machine or go for a lease agreement. The terms of the lease are as under:

The lessee must bear the maintenance charges of $ 500 per year. Depreciation is to be borne by the lessor.

Solution:

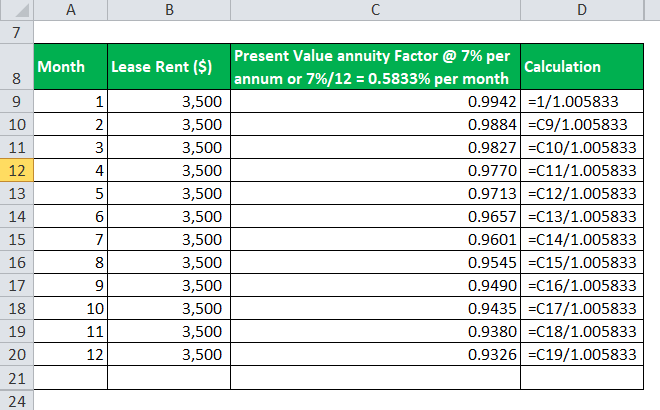

Calculation of Present Value of Lease Rent

The present value annuity Factor is calculated as

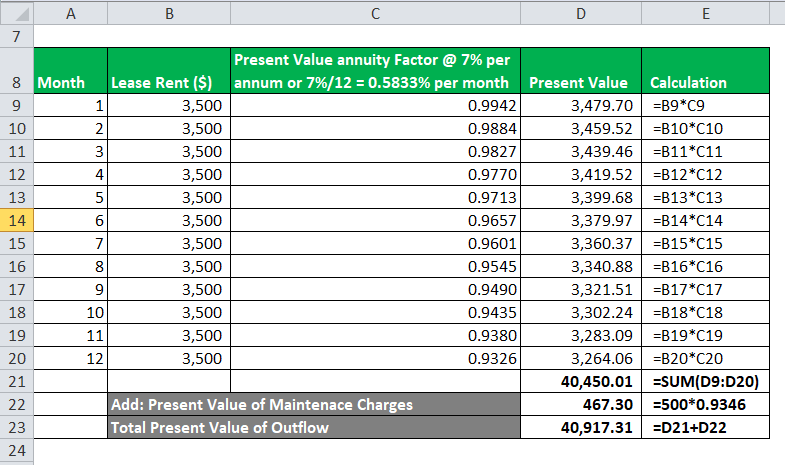

The present value is calculated as

| Month | Lease Rent ($) | Present Value annuity Factor @ 7% per annum or 7%/12 = 0.5833% per month | Present Value |

| 1 | 3,500 | 0.9942 | 3,479.70 |

| 2 | 3,500 | 0.9884 | 3,459.75 |

| 3 | 3,500 | 0.9827 | 3,439.80 |

| 4 | 3,500 | 0.9770 | 3,420.20 |

| 5 | 3,500 | 0.9713 | 3,400.60 |

| 6 | 3,500 | 0.9657 | 3,381.70 |

| 7 | 3,500 | 0.9601 | 3,362.80 |

| 8 | 3,500 | 0.9545 | 3,343.90 |

| 9 | 3,500 | 0.9490 | 3,325.35 |

| 10 | 3,500 | 0.9435 | 3,307.50 |

| 11 | 3,500 | 0.9380 | 3,288.60 |

| 12 | 3,500 | 0.9326 | 3,271.10 |

| 40,481.00 | |||

| Add: Present Value of Maintenance Charges | 467.30 | ||

| Total Present Value of Outflow | 40,948.30 |

As the Present Value of outflow is less than $ 50,000. Hence the company should go for Equipment leasing.

There are two types of Equipment leases which are explained below:

So leased equipment is an advanced concept and helps the business organization utilize the resources effectively. The demand for Equipment leasing is high in the market.

The advantages of Equipment Leasing are as under:

Disadvantages of Equipment Leasing:

It is the type of lease where the equipment, like machinery, computers, etc., are to be taken on lease instead of purchasing the same. It reduces the blockage of money. Hence the organization can invest more in other opportunities to earn better. With an equipment lease, shifting to highly advanced technology products becomes easy. But sometimes, the cost of the outflow of equipment lease can be more than the cost of equipment, which leads to loss from the equipment lease.

This is a guide to Equipment Lease. Here we also discuss the definition and types of equipment lease along with advantages and disadvantages. You may also have a look at the following articles to learn more –

6133+ Hours of HD Videos

40+ Learning Paths

750+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

4.9

42+ Hour of HD Videos

30 Courses

5 Mock Tests & Quizzes

Verifiable Certificate of Completion

Lifetime Access

4.5

48+ Hours of HD Videos

19 Courses

6 Mock Tests & Quizzes

Verifiable Certificate of Completion

Lifetime Access

4.5

all.in.one: FINANCE - 750+ Courses | 6133+ Hrs | 40+ Specializations | Tests | Certificates 6133+ Hours of HD Videos | 40+ Learning Paths | 750+ Courses | 40+ Projects | Verifiable Certificate of Completion | Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates 4655+ Hours of HD Videos | 80+ Learning Paths | 470+ Courses | 50+ Projects | Verifiable Certificate of Completion | Lifetime Access